Get in touch

555-555-5555

mymail@mailservice.com

FHA 203k Frequently Asked Questions

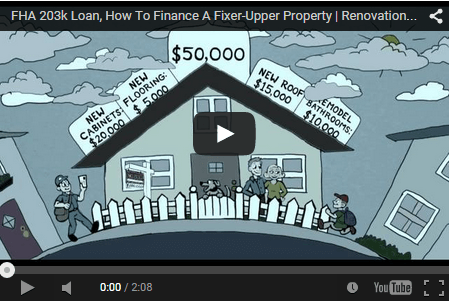

The FHA 203k Rehab Loan was established by the Department of Housing and Urban Development (HUD) and is intended to provide the important tool for the many revitalizations of communities and neighborhoods today, also to help expand opportunities of homeownership. Below are a few frequently asked questions in regard to the FHA 203k Loan Program.

Questions About Mortgage Rates

What is a Lock-In?

Also known as a rate-lock or a rate commitment, this a promise made by a lender to set aside a certain interest rate and a certain number of points for you, this request is usually for a specific period of time during the process of your loan application, so in the chance of a rate changing, yours would have already been locked in.

It can usually take your lender several weeks or even longer to prepare all of your documents and evaluate your loan application, making a lock-in offer very useful when applying for a loan.

When your interest rate and points are locked in, you won’t have to worry about your rate increasing. However, this may also prevent you from being able to capitalize in a lower rate than the one that is already locked in, depending on the leniency of your lender, he/she may be willing to try and lock in a lower rate for you if there is a decrease in rates during the time period of the loan process.

What is a Loan Commitment?

It is important not to confuse the two different terms of a lock-in and a “loan commitment” even though there may be a lock-in option for loan commitments.

With a loan commitment, the lender is making a promise in creating you a loan in a special amount at some point in the future.

Typically, the lender’s commitment is only given to you after your loan application has gone through the approval process. This commitment would usually state the loan terms that you have been approved for containing the loan amount, such as; how long the commitment is good for, and the conditions required of the lender for creating the loan, very much like a receipt of satisfactory title insurance policy protecting the lender.

How Does Loan-to-Value Affect Mortgage Rates?

Your Loan-to-Value (LTV) is one of many risk factors that banks take into consideration when originating loans that are secured by real property.

LTV is a measure of the amount of equity in a property compared to the loan balance. Interest rates tend to be more favorable for certain mortgage programs based on loan scenarios where the borrower has more equity or a larger down payment.

Click Here To Read More About 203k Mortgage Rates

Questions About Documenting Gift Funds:

Are the gift funds already present in the borrower’s bank account?

If so, a copy of the document showing the withdrawal from the donor’s account is required, as well as the deposit slip and bank statement reflecting the deposit of said funds into the borrower’s account.

Will the gift funds be provided at closing in the form of a check or money order?

If so, the donor must provide a document or canceled check showing the amount of the gift funds and their withdrawal from the donor account.

Will the funds be provided at closing as a wire transfer?

The donor must provide documented evidence of the transfer.

Will the funds be provided at closing via a loan to the donor?

The donor must provide written documentation that the funds were borrowed from an acceptable source and NOT from any party to the transaction, including the 203k lender.

Click Here To Read More About Other Down Payment Options

FAQ’s On hiring A FHA 203k Loan Contractor

Does HUD provide a list of FHA 203k Contractors?

HUD does not certify specific 203k contractors for home renovation projects that are being financed with an FHA 203k rehab loan.

It is actually up to the borrower to find their own 203k Contractor who will pass the requirements set forth by the lender’s licensing, references, insurance, experience and education guidelines.

Will my mortgage lender inspect the repairs/improvements?

It depends on whether you are doing a Standard/Full 203k or a Streamlined 203k loan.

Full / Standard 203k Loan (Structural): All work must be inspected prior to the contractor receiving each draw. This is to ensure that the work is being completed according to HUD’s standards.

Streamlined 203k (Cosmetic): The lender will perform a final inspection prior to releasing the final draw to your 203k contractor.

What is a Contingency Reserve?

A contingency reserve is a buffer amount, generally 10%-20% of the repair amount, that is set aside to cover any additional costs that are associated with the renovation project.

This protects the borrowers and sellers from having to start over with a new loan, appraisal, approval and inspection process.

It is important to note that all of the unused funds are applied to a principal reduction, and the borrower will not receive the difference back in cash at closing.

Can I do the renovation work on my own?

Yes, in special circumstances, where the borrower is a General Contractor with the proper licensing required for lender approval. However, if the lender approves the loan, the borrower can only be compensated for materials, not for time or labor. And, just like with the contingency reserve, any additional funds must be applied to a principal reduction.

Basically, it’s in the borrower’s best interest to have a certified 203k contractor complete the home renovation project.

How do contractors get paid?

203k Contractors get paid through an escrow account by the lender through a series of draws, depending on the type of 203k loan.

Click Here To Read More About Hiring A 203k Loan Contractor

If you are looking for an answer to a particular question that you do not see listed on this page, please feel free to contact us at (833) 600-0036 to speak to one of our 203k professionals today!

Let's Talk About Renovation Lending Options

Talk with a licensed renovation lender to see what your scenario or property may be eligible for.

📞 (833) 600-0036

Which Rehab Loan Is Right For You?

(833) 600-0036

Which Rehab Loan Is Best?

Speak directly with a TRUE Rehab Loan Pro with over 15 years in Renovation Lending Experience.

Get real answers, regardless of how complex you feel your financing scenario may be.

HIRE Licensed Pros

- Renovation Lending Specialists

- Home Improvement Contractors

- Home Inspectors & Appraisal

- Real Estate Agents & Brokers

- Energy Efficient Home Services

- FHA 203k Loan Consultants

LOAN Programs

- Home Improvement Refinance

- FHA 203k Streamlined Loans

- FHA 203K Full Rehab Loans

- Fannie Mae HomeStyle® Renovation

- VA Renovation Loan Options

- USDA Renovation Loans

LEARNING Center

- Renovation Loan Options

- Shopping Mortgage Rates

- Loan Approval Process

- Understanding Credit Scores

- Mortgage Payment Calculator

- Mortgage Glossary

ABOUT Our Network

Rehab Loan Network is an National online community of licensed renovation mortgage lenders, real estate agents, and home improvement contractors who provide tips and advice for homeowners who need rehab loan options to finance their purchase or refinance.

© 2023 All Rights Reserved

This is not a Government website. RehabLoanNetwork.com is not endorsed by the Department of Veterans Affairs or the US Department of Housing and Urban Development. The content on this site is for educational purposes only and is not an advertisement for a product or an offer to lend. If you have questions about the loan officers featured within our lender directory, please visit the Nationwide Mortgage Licensing System & Directory for more information and to check their licensing status at https://www.nmlsconsumeraccess.org.