Get in touch

555-555-5555

mymail@mailservice.com

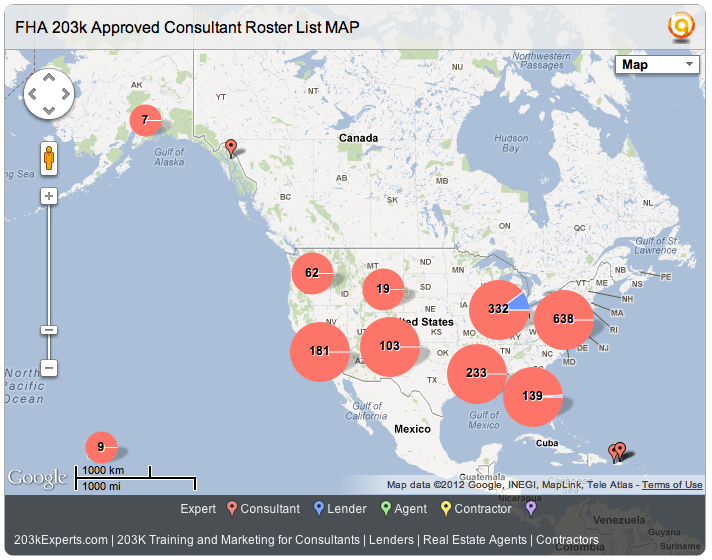

FHA 203k Loan Consultants

Borrowers who choose the full standard 203k will partner with a HUD Certified Consultant on their loan. The 203k Consultant’s job is to provide value and protection during the 203k renovation and is tasked with protecting the homeowner and ensuring that the renovation is completed according to the homeowner’s wishes.

Although the Consultant can be a vital resource, especially for first-time buyers or renovators, they are not created equally, and the homeowner must choose wisely. An experienced 203k Renovation Loan Officer who works with a roster of excellent Consultants will be able to make arrangements or recommendations about the appropriate Consultant-homeowner partnership for you.

New Paragraph

The 203k Consultant’s Role

The Consultant’s role is to review and verify the accuracy of the contractor’s estimates and ensure that all required repairs are completed. They do not make a decision about which repairs should or should not be made.

The Consultant’s first task during the loan process is to perform an initial property inspection. If the homeowner is unfamiliar with repairs required by FHA guidelines, they should involve the Consultant as soon as possible. If the borrower has a good grasp of what is needed, the Consultant can be brought in after the contractor has submitted bid(s).

The Consultant is also responsible for obtaining signed Lien Waivers during draw inspections, to be sure that sub-contractors have been compensated correctly and to protect the homeowner from mechanic’s liens. If you are not happy with the quality of the work, the Consultant will request that the contractor correct any issue prior to payment.

Teaming up with a FHA 203k Consultant

With the amount of moving parts involved in successfully closing a 203k loan on time, the designated 203k Loan Consultant is a key player on your Rehab Loan Team.

The following bullets highlight the main responsibilities your 203k Loan Consultant will be paying close attention to prior to your loan closing:

1) Initial Consultation

If you choose your HUD 203k Consultant prior to writing an offer, your consultant can help you make an informed decision before you buy. The Consultant is not a home inspector, but they can make an onsite visit and provide an idea of potential rehab costs and FHA requirements, which may allow you to negotiate a better purchase price.

Establish whether or not the borrower has a contractor. Review all mandatory disclosures and educate the client so they are more knowledgeable about the process. In addition to helping a borrower find a contractor, a good Consultant will also review forms the borrower will be required to sign at the close, including:

- Consultant Agreement

- Borrower’s Acknowledgement

- Borrowers Acceptance of Conditions

- Rehabilitation Agreement

- Homeowner/Contractor Agreement

- Self Help Agreement

2) Initial Property Inspection

If the property is already under contract, your HUD 203k Consultant will perform a site visit and feasibility analysis to determine FHA-required repairs and gain an understanding of upgrades and modifications the client desires. A good Consultant will be familiar with property values, and with the type of improvements that enhance a home’s value. These suggestions can assist the homebuyer with establishing an excellent equity position once the renovation is complete.

At this time, the Consultant will complete a limited property inspection report, also know as the 203k Program Compliance Report, designed to identify property defects that will require repair to bring the property to FHA’s Minimum Property Standards (MPS) https://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/ramh/mps/mhsmpsp

The Consultant will also input the buyer’s list of requested, additional repair or remodel items, such as new flooring or the addition of dual pane windows.

3) FHA 203(k) Lender Write-Up

A scope of work document is created by the Consultant for contractor’s bid specifications. This document describes the entire project in clear, unambiguous detail so all contractors bid the same list of required repair and remodel items.

The Contractor uses the Scope of Work Contractor Bid Package to provide the homebuyer with a detailed bid that reflects the total cost of improvements, including labor and materials. The Consultant will negotiate with contractors, thereby helping the borrower get the most out of the repair budget.

Next, your HUD 203k Consultant will prepare a detailed description of the property repairs needed for your lender. The Write-up will include the borrower’s desired upgrades, as well as what will be required to satisfy the lender, FHA and building code compliance. The Work Write-up will include detailed line item descriptions and pricing, and will be prepared with the homebuyer’s budget in mind. Although the HUD 203k Consultant does not decide how much the buyer should pay for upgrades, they do have primary responsibility for establishing a basic value for the renovations.

Once the bid specs are complete and a cost projection is calculated by the Consultant, the specs are reviewed by the borrower for corrections, deletions, or additions.

4) Prepare Contractor Bid Packages

Once the Work Write-up is reviewed and approved by the borrower, a final written estimate, called a Scope of Work, is created to provide Contractors with a bid package. A well-done scope of work will help contractors return the best bid possible. Your HUD 203k Consultant will prepare detailed Contractor packages that will help bring in better bids – and help YOU make a better decision about which Contractor is right for you and your project.

The final bid specifications are submitted to experienced renovation contractor(s), who ideally have been identified early in the process. Bid(s) are returned to the Consultant.

5) Work Write Up

The Consultant now prepares the Work Write Up required by the lender to order the appraisal and process the loan. This consists of a summary page, the contracts listed in Step 1, and any Architectural Exhibits, which are documents that may include a sketch of the building if a wall is being relocated, or plat map showing an existing septic or well.

6) Facilitate Contractor Relationships

The HUD 203k Consultant will work directly with your Contractor and Lender to be sure you receive the quality work you deserve. The Consultant is also responsible for obtaining signed Lien Waivers during draw inspections, to be sure that sub-contractors have been compensated correctly and to protect the homeowner from mechanic’s liens. If you are not happy with the quality of the work, the Consultant will request that the Contractor correct any issue prior to payment. In addition, your HUD 203k Consultant will ensure all times that enough funds remain to complete the project.

Did You Know?

A rehab loan can be used for a purchase or refinance, and you do not have to be a first-time homebuyer to use it. Contact Us today at (833) 600-0036 to see how a 203k loan can increase the value of your property.

Let's Talk About Renovation Lending Options

Talk with a licensed renovation lender to see what your scenario or property may be eligible for.

(833) 600-0036

CLICK HERE to submit a contact request form online, or feel free to Call us @ (833) 600-0036 to speak with a licensed renovation lender directly.

Which Rehab Loan Is Best?

Speak directly with a TRUE Rehab Loan Pro with over 15 years in Renovation Lending Experience.

Get real answers, regardless of how complex you feel your financing scenario may be.

HIRE Licensed Pros

- Renovation Lending Specialists

- Home Improvement Contractors

- Home Inspectors & Appraisal

- Real Estate Agents & Brokers

- Energy Efficient Home Services

- FHA 203k Loan Consultants

LOAN Programs

- Home Improvement Refinance

- FHA 203k Streamlined Loans

- FHA 203K Full Rehab Loans

- Fannie Mae HomeStyle® Renovation

- VA Renovation Loan Options

- USDA Renovation Loans

LEARNING Center

- Renovation Loan Options

- Shopping Mortgage Rates

- Loan Approval Process

- Understanding Credit Scores

- Mortgage Payment Calculator

- Mortgage Glossary

ABOUT Our Network

Rehab Loan Network is an National online community of licensed renovation mortgage lenders, real estate agents, and home improvement contractors who provide tips and advice for homeowners who need rehab loan options to finance their purchase or refinance.

© 2023 All Rights Reserved

This is not a Government website. RehabLoanNetwork.com is not endorsed by the Department of Veterans Affairs or the US Department of Housing and Urban Development. The content on this site is for educational purposes only and is not an advertisement for a product or an offer to lend. If you have questions about the loan officers featured within our lender directory, please visit the Nationwide Mortgage Licensing System & Directory for more information and to check their licensing status at https://www.nmlsconsumeraccess.org.