Get in touch

555-555-5555

mymail@mailservice.com

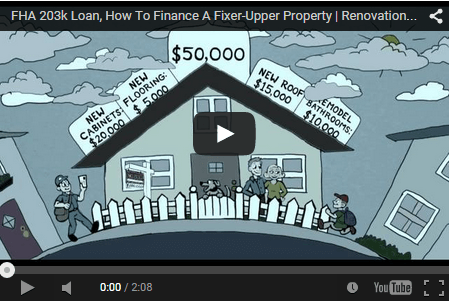

FHA 203k Full Renovation Loan

The Standard 203k was created specifically for projects that warrant extensive work or repairs, projects that will take longer than six months to complete, or when rehab costs will exceed $35,000. Additionally, Standard 203k loans have no maximum repair amount.

The Standard (k) loan option must be used when a property requires (or the borrower requests) structural work, such as a room addition or the removal or relocation of an interior or exterior wall.

Let's Talk About Renovation Lending Options

See which Renovation Mortgage Program your scenario or property may be eligible for.

203k Loans

Basics Of A Full FHA 203k Rehab Loan

A Standard 203k is also used if the project requires engineering or exterior grading or inspections. The Standard 203k must be used if the renovation work will prohibit the homeowner from occupying the residence during the process.

If the home is considered uninhabitable, up to six months of mortgage payments can be financed to cover monthly loan payments during the renovation process and help the homeowner pay for alternate housing during construction.

On a Standard 203k loan, FHA requires that a FHA-designated Consultant create and document a work plan before they will approve the loan.

The maximum mortgage amount allowed for a standard 203k is based on whichever is less:

- The as-is value of the property plus the costs of repair and rehabilitation.

- 110% of the projected value of the renovated property.

All 203k programs allow borrowers to finance the purchase price of the property, the closing costs, plus the cost of repairs.

Did You Know?

A rehab loan can be used for a purchase or refinance, and you do not have to be a first-time homebuyer to use it. Contact Us today at to see how a 203k loan can increase the value of your property.

Which Rehab Loan Is Best?

Speak directly with a TRUE Rehab Loan Pro with over 15 years in Renovation Lending Experience.

Get real answers, regardless of how complex you feel your financing scenario may be.

HIRE Licensed Pros

- Renovation Lending Specialists

- Home Improvement Contractors

- Home Inspectors & Appraisal

- Real Estate Agents & Brokers

- Energy Efficient Home Services

- FHA 203k Loan Consultants

LOAN Programs

- Home Improvement Refinance

- FHA 203k Streamlined Loans

- FHA 203K Full Rehab Loans

- Fannie Mae HomeStyle® Renovation

- VA Renovation Loan Options

- USDA Renovation Loans

LEARNING Center

- Renovation Loan Options

- Shopping Mortgage Rates

- Loan Approval Process

- Understanding Credit Scores

- Mortgage Payment Calculator

- Mortgage Glossary

ABOUT Our Network

Rehab Loan Network is an National online community of licensed renovation mortgage lenders, real estate agents, and home improvement contractors who provide tips and advice for homeowners who need rehab loan options to finance their purchase or refinance.

© 2023 All Rights Reserved

This is not a Government website. RehabLoanNetwork.com is not endorsed by the Department of Veterans Affairs or the US Department of Housing and Urban Development. The content on this site is for educational purposes only and is not an advertisement for a product or an offer to lend. If you have questions about the loan officers featured within our lender directory, please visit the Nationwide Mortgage Licensing System & Directory for more information and to check their licensing status at https://www.nmlsconsumeraccess.org.