Refinance And Renovate Your Home With 203k

Let's Talk About Renovation Lending Options

See which Renovation Mortgage Program your scenario or property may be eligible for.

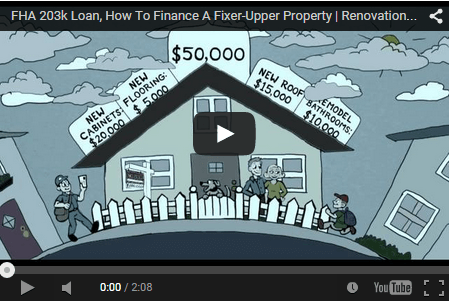

203k Loans

The FHA 203k Home Improvement Refinance Program

You can increase the living area in your home by adding a second story, or you can simply upgrade your kitchen, flooring or walls with a home improvement refinance through through the FHA 203k program.

In addition to offering regular purchase and home improvement loans, the FHA Streamlined Refinance is a program designed to speed up a simple rate and term refinance by requiring less documentation.

The renovation opportunities through FHA’s 203k refinance program may range from relatively minor (though exceeding $5000 in cost) to a reconstruction: a home that has been demolished or will be razed as part of rehabilitation is eligible, for example, provided that the existing foundation system remains in place.

Section 203k insured loans can finance the rehabilitation of the residential portion of a property that also has non-residential uses; they can also cover the conversion of a property of any size to a one- to four- unit structure. The types of improvements that borrowers may make using Section 203(k) financing include:

- structural alterations and reconstruction

- modernization and improvements to the home’s function

- elimination of health and safety hazards

- changes that improve appearance and eliminate obsolescence

- reconditioning or replacing plumbing; installing a well and/or septic system

- adding or replacing roofing, gutters, and downspouts

- adding or replacing floors and/or floor treatments

- major landscape work and site improvements

- enhancing accessibility for a disabled person

- making energy conservation improvements

For all properties financed with a 203k loan, both the lender and FHA have repair requirements that must be addressed, in addition to the type and extent of work the borrower would like to complete. FHA requires that properties financed under the 203k program meet certain basic energy efficiency and structural standards to comply with HUD’s Minimum Property Standards and all local codes and ordinances.

FHA’s energy efficiency standards include correctly sized heating and air conditioning systems, as well as the type and extent of caulking, insulation and ventilation. The home is also required to have smoke detectors adjacent to each sleeping area.

Homeowners, whose home is in need of home improvement may refinance with FHA’s may be eligible for refinance through the FHA 203k streamline or the standard FHA 203k refinance program as long as it is currently a FHA-approved mortgage. The typical 203k loans are for properties needing structural repairs, whereas the streamline is available for non-structural.

To qualify for these loans, the borrower is required to have intentions of living in the home in need of repairs. The following eligible properties are:

- Existing construction (at least a year old)

- Single family, two-family, three-family, or four family dwellings.

- Condominiums

- A mixed residential/commercial property may qualify as long as you are repairing only the home portion.

- Homes that need to be relocated to a new foundation.

- Tear-downs – houses that need to be destroyed or rebuilt (as long as a part of the foundation remains).