What Is An FHA 203k Loan ?

About The FHA 203k Loan

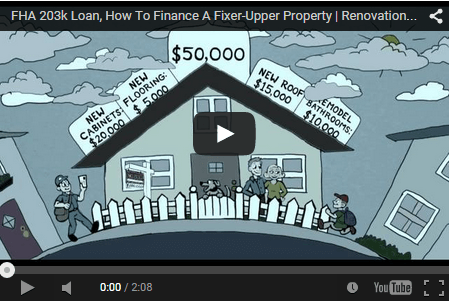

If you are searching for a home to buy and you cannot find the perfect home within your budget in the best location that has the exact carpet, tile, kitchen cabinets, granite counter tops and paint that you want, then the FHA 203k Loan is the exact solution you need.

Known by many similar names as the FHA 203k Rehab Loan, 203(k) Streamlined or 203K Consultant K loans, the FHA 203k Loan is basically the technical term for the Section 203(k) Rehab Mortgage Insurance, which is a type of government insured mortgage program that allows homebuyers and owners the ability to finance renovation costs through a single home loan during a purchase or refinance.

Two Different Types Of 203(k) Loans:

The reason for the different names is that there are actually two types of FHA 203k loans: the “Streamlined 203(k)” for cosmetic upgrades and the “Full Consultant K” version for structural repairs.

The Standard 203(k)

Referred to as the Full 203K Consultant K or Original K, it is intended for more complicated projects that involve structural changes such as room additions, exterior grading and landscaping. A Full K is also used if your project requires engineering or architectural drawings and inspections. One benefit with this form of the 203(k) is that a single-family property may be converted into a two, three or four-unit dwelling or vice versa so long as the owner occupies one of the units.

The Streamlined 203(k)

The 203(k) Streamlined Loan is designed primarily for cosmetic upgrades that will not exceed a total of $35,000 in renovation and related expenses. This version does not require the use of a consultant, architect, and engineer or as many inspections as the Standard 203(k). With only a few additional steps, the Streamlined 203(k) is a popular option when a typical FHA loan is considered since upgraded flooring, paint and a kitchen seem to be the easiest way to quickly turn a house into a home.

Either way, we’ll reference both versions as the general “FHA 203k” program to keep things simple throughout our explanations on this site.

What Is The Purpose Of FHA 203k Loans?

The 203k rehabilitation mortgage program was created to fill an important need in expanding homeownership opportunities while revitalizing communities and neighborhoods by providing financing for properties that need renovation work to make them livable or sellable.

For most traditional mortgage loans, homebuyers purchasing properties in need of minor or major repair would be responsible for paying for those upgrades out-of-pocket. And if any of those improvements were a condition of the financing as highlighted in a home inspection, such as a missing kitchen sink or a fire damaged property, then those repairs would have to be made prior to the loan closing.

Think about the number of foreclosures and short sales that are listed on the market at a discount to cash investors due to the amount of renovation work necessary just to make the properties move-in ready.

The FHA 203k Loan fills that gap and helps a buyer who will be the primary resident, not an investor landlord, upgrade that property and maintain the integrity of the values in the neighborhood.

CLICK HERE to submit a contact request form online, or feel free to Call us @ (833) 600-0036 to speak with a licensed renovation lender directly.

Let's Talk About Renovation Lending Options

Talk with a licensed renovation lender to see what your scenario or property may be eligible for.

📞 (833) 600-0036